Stock Market 101 – Lesson 12

Building a Starter Portfolio: 3 Simple Recipes for Beginners

Hook: Why most beginners lose confidence before they lose money

Almost every new investor starts with excitement. A few apps, a few YouTube videos, and suddenly the question hits hard:

“What should I actually buy, and how much?”

This is where most beginners get stuck. Not because investing is complicated—but because no one explains how to build a simple, sensible portfolio without stress.

In this lesson, we’re fixing that.

No fancy formulas.

No stock tips.

No “get rich quick” promises.

Just three starter portfolio recipes that real beginners can follow with confidence.

What Is a Starter Portfolio (in plain English)?

A starter portfolio is your first structured investment plan.

It answers three simple questions:

Where should my money go?

How much risk am I taking?

What do I do when markets move up or down?

A good starter portfolio is not about chasing returns.

It’s about surviving long enough to grow.

Before You Invest: One Rule You Must Follow

Before any portfolio, there is one non-negotiable rule:

Emergency Fund Comes First

You should keep 6–12 months of essential expenses in a safe place like:

Savings account

Liquid mutual fund

Fixed deposit

This money is not for investing.

It protects you from selling investments during emergencies or market crashes.

Once this is ready, you move to investing.

Portfolio Recipe 1: The Goal-Based Beginner Mix

Best for: Absolute beginners, first-time investors, low stress preference

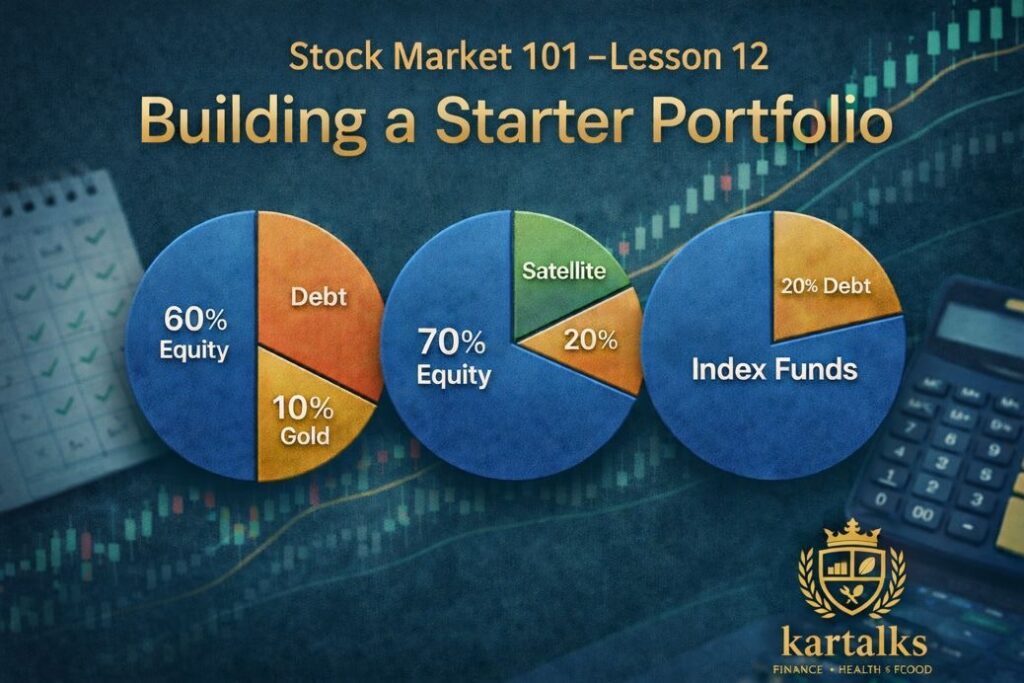

How it looks

60% Equity (Index Funds)

30% Debt (Debt or Hybrid Funds)

10% Gold (Gold ETF or Sovereign Gold Bonds)

Why this works

This portfolio balances growth and safety. Equity helps your money grow. Debt reduces volatility. Gold acts as a shock absorber during market stress.

You won’t see dramatic ups and downs, but you’ll sleep better—and that matters more than returns.

Who should choose this

First-time investors

People investing monthly through SIP

Those who panic easily during market falls

Portfolio Recipe 2: Index Core + Small Satellite

Best for: Beginners who want growth but still value simplicity

How it looks

70% Index Funds (Nifty 50 / Sensex / Total Market)

20% Satellite (Mid-cap, Small-cap, or Sector fund)

10% Debt or Gold

Why this works

Your core (index funds) does most of the heavy lifting.

The satellite adds extra growth potential—but it’s limited so mistakes won’t hurt badly.

Think of the satellite as spice, not the main dish.

Who should choose this

Investors with 5–10-year goals

People comfortable with mild ups and downs

Those who want exposure beyond index funds

Portfolio Recipe 3: The Ultra-Simple Index Portfolio

Best for: Busy professionals, long-term investors, minimal decisions

How it looks

100% Index Funds

or80% Index + 20% Debt

Why this works

Index investing removes emotion from investing. You’re betting on the growth of the economy, not on individual stocks.

Over long periods, this approach has quietly beaten most complicated strategies.

Who should choose this

Long-term wealth builders

Investors who don’t want frequent changes

People who believe consistency beats complexity

How Much Should You Invest Monthly?

Instead of asking “how much should I invest,” ask:

“How much can I invest comfortably without stress?”

A good starting rule:

20–30% of monthly income if possible

Start smaller if needed, but start consistently

The habit matters more than the amount.

Rebalancing: The One Skill That Saves Portfolios

Markets move. Your portfolio won’t stay balanced automatically.

What is rebalancing?

Rebalancing means bringing your portfolio back to its original allocation.

Example:

Equity grows from 60% to 75%

You sell a little equity and add to debt or gold. Investopedia

How often should beginners rebalance?

Once a year is enough

Or when allocation changes by more than 5–10%

Rebalancing forces you to:

Sell high

Buy low

Without emotions

Common Beginner Mistakes to Avoid

Changing portfolio every few months

Investing without an emergency fund

Adding too many funds

Panicking during market corrections

Copying someone else’s portfolio blindly

A good portfolio is boring—and boring portfolios usually win.

Simple Checklist Before You Start

✔ Emergency fund ready

✔ Clear goal and time horizon

✔ One of the three recipes chosen

✔ SIP set up

✔ Annual rebalance reminder

If all five are ticked, you’re already ahead of most investors.

How Your Portfolio Should Change as You Grow

One mistake beginners often make is believing that the first portfolio must be permanent.

It doesn’t.

A starter portfolio is like learning to ride a bicycle with training wheels. At some point, you gain balance, confidence, and experience—and you adjust.

Early Stage (0–3 years)

At this stage:

Your income is still stabilizing

Your confidence is developing

Market corrections feel emotionally heavy

Here, simplicity matters more than returns. Stick to one index fund, one debt fund, and optional gold. Your main job is not optimization—it’s discipline.

Growth Stage (3–7 years)

Once you’ve stayed invested through at least one market correction, something changes. You stop reacting emotionally.

This is when you may:

Increase equity allocation gradually

Add a second index (like mid-cap exposure)

Reduce unnecessary safety buffers

But even here, changes should be slow and intentional, not reactive.

Maturity Stage (7+ years)

By now, your portfolio reflects your life:

Family responsibilities

Career stability

Clear financial goals

At this stage, portfolios become more goal-driven than return-driven. Some money is meant to grow aggressively, while some is meant to protect what you’ve already built.

Why Consistency Beats Intelligence in Investing

Many beginners believe successful investors are smarter.

In reality, most successful investors are simply more consistent.

They:

Invest every month, even when markets are boring

Don’t stop SIPs during crashes

Don’t chase what’s trending

Your starter portfolio is not meant to make headlines.

It’s meant to stay alive through decades.

A Gentle Reminder Before You Begin

If you remember only one thing from this lesson, remember this:

You don’t need to know everything to start investing.

You just need a simple plan and the courage to stick with it.

Start small. Stay patient. Let time do the heavy lifting.

Final Thought: Start Simple, Stay Consistent

You don’t need the perfect portfolio.

You need a good enough portfolio that you can stick with.

Markets will rise. Markets will fall.

But a simple, well-balanced starter portfolio keeps you moving forward—quietly and steadily.

That’s how real wealth is built.

👉Furtherreading

Stock Market 101 – Lesson 11 MA, RSI & MACD

Mutual Funds Explained:Types, Returns & Risks

Stock Market 101 – Chart Patterns Explained

Stock Market 101– Lesson 9: Technical Analysis

Stock Market 101: Learn Stocks from Zero

Disclaimer:

This article is for educational purposes only and does not constitute financial advice. Please consult a qualified advisor before making investment decisions.