In this Indian Muhurat trading closing report 2025, we analyze how the markets performed during the auspicious Diwali session, including key indices, top gainers, and overall investor sentiment.

📊 Closing Levels (Special One-Hour Session)

Nifty 50: 25,868.60, up ~0.10% (+25.45 pts).

BSE Sensex: 84,426.34, up ~0.07% (+62.97 pts).

Bank Nifty: Approximately 58,007.20, down ~0.04% (-26 Pts)

📌 Insight: Market ended the auspicious session modestly higher — reflecting positive sentiment but cautious trading given the brief duration.

🏅 Top 3 Gainers & Top 3 Losers

Gainers

Cipla: Strong pick during the session, up ~ +1.5%

Infosys: Tech stock among the top performers, up ~+1.1%

Mahindra & Mahindra (M&M): Auto/industrial stock showing strength, ~ + 0.61%

Losers

ICICI Bank: Banking heavyweight dragged by cautious flow, ~ – 0.6%

Kotak Mahindra Bank: Under-performed during the session, ~ – 0.9%

Asian Paints: Fell on profit-taking despite broader market flatness, ~ – 0.6%

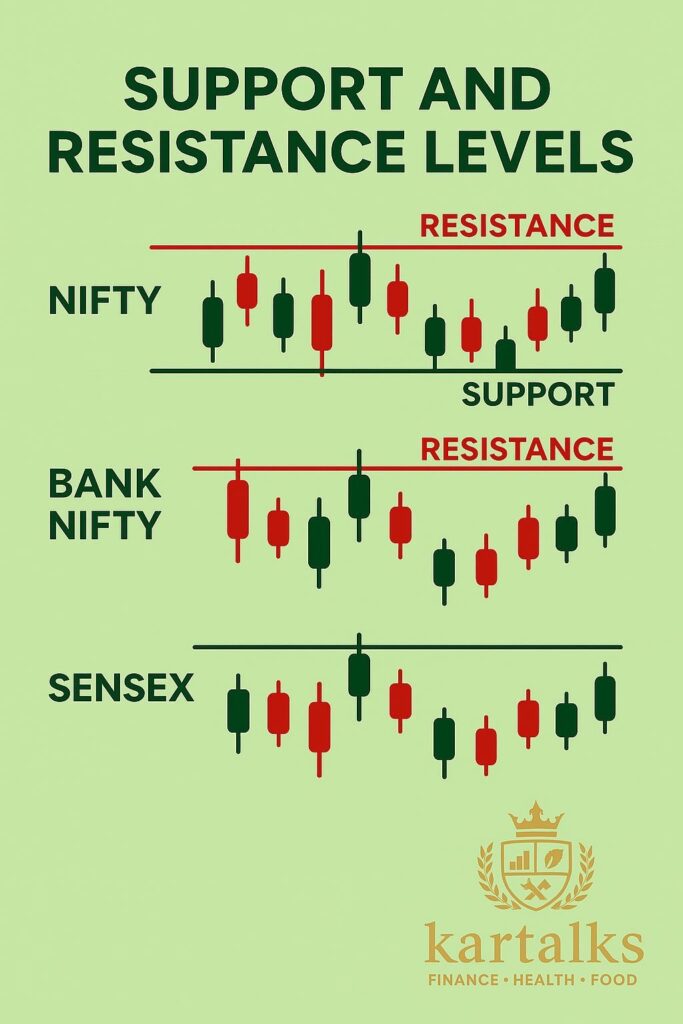

🧱Support & Resistance Levels

Nifty 50

Support: ~ 25,350 – 25,550

Resistance: ~ 25,900 – 26,100

Bank Nifty

Support: ~ 56,700 – 57,000

Resistance: ~ 57,950 – 58,540

Sensex

Support: ~ 82,800 – 83,400

Resistance: ~ 84,300 – 85,300

📌 These levels will guide tactical trading during the next few sessions — use them as reference anchors.

🧠 Stock Results & Market Impact

Strong earnings from key large-cap names have helped underpin the positive mood. (e.g., banking/financials)

Broadly, the market participated in the Muhurat session with symbolic buys rather than heavy volume breakouts.

Mid-cap and small-cap segments showed outperformance relative to large-caps in the session.

😶🌫️ Volatility Gauge (VIX)

India VIX: Closed around 11.30, indicating low but stable volatility.

Interpretation: Low VIX suggests calm sentiment — favourable for investment-buying in the near-term, but also means sharp breakouts may need catalysts.

📊 FII & DII Activity

On 20 Oct 2025:

FII: Net buy ~ ₹790.45 crore.

DII: Net buy ~ ₹2,485.46 crore.

On 21 Oct 2025 (Today)

FII: Net buy ~ ₹96.72 crore.

DII: Net sell ~ ₹607 crore.

These flows reflect steady institutional accumulation in the cash market on the eve of the new financial year.

🆕 IPO / Primary Market Update

The Muhurat session often coincides with symbolic investment starts for the new financial year.

Look out for upcoming IPOs with high subscription interest; institutional backing remains key. (No major IPO launch data explicitly captured in sources for today.)

🎯 Stock of the Day

Infosys: Technology name showing relative strength in the session, and emerging as a favoured large-cap pick for Samvat 2082.

Why watch it: Good visibility, recent earnings, and sector leadership — suitable for symbolic buy in Muhurat hour with potential to scale later.

💡 Investment Ideas

Short-Term (weeks to few months)

Consider adding or initiating fresh positions near support levels (e.g., Nifty ~25,350-25,550). Monitor breakout above resistance (Nifty ~25,900-26,100) for momentum trades.

Long-Term (12-36 months)

Focus on high-quality large-cap stocks (financials, tech, industrials) with symbolic Muhurat buys as entry points. Use the Muhurat session as a starting anchor, and build via SIP/average over time.

⚠️ Key Risks

The session duration is shortened — momentum may lack depth.

Without strong global or domestic triggers, markets may consolidate rather than zoom upward.

Institutional flows, while positive, are modest — sudden outflows could give sharp dips.

More details 👇

⚠️ Disclaimer:

This information is provided for educational and informational purposes only and does not constitute a solicitation or recommendation to buy or sell any securities or financial instruments. Please conduct your own due diligence and/or consult a SEBI-registered financial advisor before making any investment decisions. Past performance is not indicative of future results. Investing in equities, derivatives and commodities involves risk, including loss of principal. The views expressed herein are those of the author at the time of writing and may change without notice.