October 24,2025

🌍 Global Cues & GIFT Nifty

🌐 Global Market Cues

Asian equities opened higher: Nikkei 225 rose ~0.8%, Kospi up ~1% and ASX 200 modestly positive, driven by improved trade talk sentiment.

The upcoming Donald Trump-Xi Jinping meeting has revived hopes of a trade breakthrough between the U.S. and China — this, in turn, bolsters India’s export & manufacturing outlook.

Commodities:

Crude oil remains under pressure, helping input-cost sensitive sectors;

gold and silver steadied as safe-haven appeal continues.

Currency: The Indian rupee is holding near ₹88/USD, which suggests manageable import cost pressures for now.

📈 GIFT Nifty Status

GIFT Nifty is trading around ≈ 26,034.50 points in the pre-open phase.

Interpretation: A GIFT-Nifty premium above 26,000 indicates a likely positive open for Indian markets — the benchmark Nifty 50 could gap up, assuming domestic conditions hold.

🧭 What This Means for India’s Open

A positive GIFT Nifty and upbeat global cues set the stage for a strong market open.

However, the trade-deal optimism is already baked in; any lack of follow-through or surprise could lead to consolidation rather than a strong breakout.

Watch for premium GIFT Nifty reads as an early signal — if it drops from current levels, the market may open flat or with a fade.

🇮🇳 Market Snapshot: Key Levels

Nifty 50: Close above ~ 25,890 points.

BSE Sensex: Close near ~ 84,556 points. Bank Nifty: Trading near ~ 58,000 region.

With GIFT Nifty signalling strong upside, markets likely open on a bullish note — but profit-booking is possible if domestic sentiment doesn’t keep up.

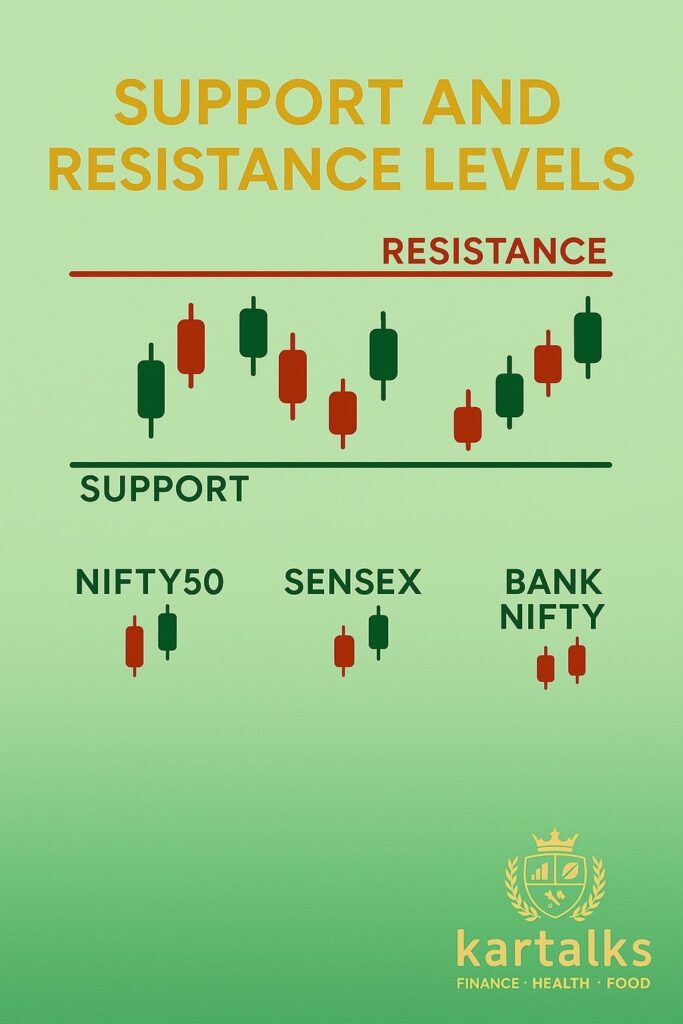

🧱 Support & Resistance Zones

Nifty 50

Support: ~ 25,550 – 25,700

Resistance: ~ 26,000 – 26,200 (breakout zone if tariff deal confirmed)

Sensex

Support: ~ 83,300 – 84,000

Resistance: ~ 85,000 – 85,300

Bank Nifty

Support: ~ 57,200 – 57,400

Resistance: ~ 58,500 – 59,000

These zones will help you gauge potential bounce or pull-back levels for intraday and short-term trades.

📉 Yesterday’s (23.10.2025) Market Behaviour – Brief Recap

The market extended its winning streak for a sixth session as optimism around the India-US trade talks continued to fuel buying.

Yet, despite the strong start, profit‐booking dragged the indices off their intraday highs. Nifty touched ~26,100 but closed near 25,891, while Sensex hit ~85,272 before settling at ~84,556.40.

The driver was tech and export names; however, selective strength and narrow breadth suggest caution is warranted.

🔍 Major Stocks & Their Impact

Tech/IT stocks led the rally, benefiting from trade-deal optimism and H-1B visa commentary.

Export/manufacturing names are under spotlight — tariff relief would enhance their competitiveness.

Banks continue to be key: a strong banking sector will support market breadth. Stick with large-caps with clear earnings visibility as smaller names may face sharper swings.

📊 Open Interest & Put-Call Ratio Snapshot

Latest OI data for Oct expiry shows:

Call OI ~ 13.60 crore vs Put OI ~ 13.51 crore → PCR ~ 1.00. This indicates a neutral to mildly bullish setup — heavy Call writing near resistance (26,000-26,200) and Put accumulation near support (25,600-25,700) may cap runaway rallies.

😶 Volatility Indicator: India VIX

The India VIX remains subdued (~11-12 levels). A low VIX typically supports sustained up-moves but also signals limited downside expectation. Keep a close eye on any spike, which may herald increased risk or reversal.

🆕 IPO & Primary Market Update

With trade-deal optimism and improved earnings visibility, IPO sentiment remains constructive. Monitor upcoming issues for subscription strength and aftermarket performance — they can act as leading indicators of cash flow and risk appetite.

🇮🇳 FII & DII Flows

Recent commentary suggests DIIs are backing the market, while FIIs are gradually returning.

🛢 Commodity & Currency Update

Crude Oil: Any softness is a positive factor for margin-sensitive sectors and inflation monitoring.

Gold & Silver: Safe-haven demand remains; gold in India remains above ₹1.27 lakh/10g; silver similarly elevated.

Currency: The rupee remains around ~₹88/USD; any sharp weakness could hurt import-intensive names.

These commodity/currency trends interplay with market strength and should not be overlooked.

🎯 Investment Ideas

Short-Term (weeks)

Use dips toward support zones for tactical buys, particularly in export/tech/banking names. Breakout above resistance may signal opening of fresh leg upward — but discipline is key.

Long-Term (12-36 months)

Focus on structural themes: banking, export manufacturing, digital/tech platforms. Leverage the current momentum but don’t chase; build positions in tranches.

⚠️ Risk Checklist

Trade-deal may be delayed or terms may disappoint – could dampen momentum. Global macro shocks (rates, China, oil) could reset risk appetite quickly. Narrow leadership (few sectors driving the move) implies that broader market may lag — diversification matters.

“For more information check our

FAQs “

“HRITIK Stocks Q2 Key Results ; Insights”

📌 Disclaimer:

This article is for educational/informational purposes only and does not constitute a solicitation or recommendation to buy or sell any securities or financial instruments. Investors should conduct their own due diligence and consult SEBI-registered financial advisors before making investment decisions. Past performance is not indicative of future results. Investing in equities, derivatives and commodities involves risk of loss of principal. The views expressed herein are those of the author at the time of writing and may change without notice.

📚 Further Reading