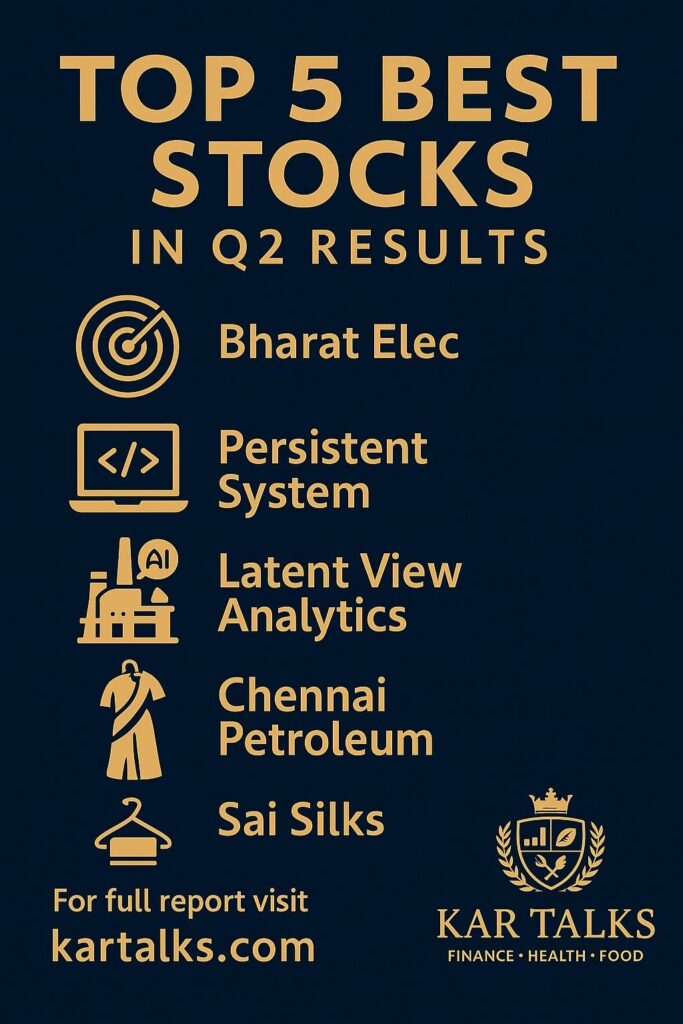

“Q2 FY26 scorecard + fundamentals + quick TA + what to watch”

1) Bharat Electronics (BEL)

What Q2 says: BEL delivered another solid quarter: standalone PAT up ~18% YoY to ₹1,286 cr; revenue up ~26% YoY—defence execution + order flow doing the heavy lifting.

Shareholding (Sep ’25): Promoter ~51.14%; FII ~18% (trend improving vs last year). Low/no pledges.

Fundamentals snapshot: Almost debt-free; 3-yr ROE ~26%; 5-yr profit CAGR ~24%; healthy dividend habit.

CMP context: ~₹426 at Oct-31 close (NSE).

Valuation read: After the run, BEL often trades rich on P/B, but the market pays up for visibility (radars, EVMs, communication systems, exports).

Quick TA (daily): Primary trend up; dips toward prior swing zones tend to be bought as long as the index risk backdrop is calm. Use trailing stops; avoid chasing gap-ups.

Growth drivers: Defence indigenisation, exports, lifecycle support; capex light vs revenue scale.

How to use: Accumulate on orderly pullbacks, stagger entries; avoid leverage into results/newsflow spikes. (Education only.)

Bharat Electronics is no stranger to headlines. Defence spending is increasing, and BEL continues to sit in the sweet spot — radar systems, communication solutions, missile support technology and electronics for the armed forces.

Why this quarter stood out

Revenue and profit moved higher steadily, but more importantly, the order book visibility strengthened. Defence capex in India remains strong and BEL is benefitting as the dependable government electronics partner.

Valuation tone

BEL trades at a premium valuation compared with traditional PSU firms. A high PE multiple shows market confidence — and the expectation that earnings will keep compounding.

Investor takeaway

This is a business where patience pays. Not a fast “trader stock,” but a steady compounding-style government-backed defence play. Pullbacks often attract institutional interest.

2) Persistent Systems

What Q2 says: Revenue $406.2M (+4.2% QoQ, +17.6% YoY); operating margin 16.3%—22nd consecutive sequential growth quarter.

Shareholding (Sep ’25): Promoter ~30.6%; FIIs ~21–24% band; zero pledges.

Fundamentals snapshot: Practically debt-free; strong 5-yr profit CAGR (~33%); steady margins in the mid-teens; improving NP margin.

CMP context: ~₹5,917 at Oct-31 close.

Valuation read: Quality commands premium—rich on P/B; the key is sustained growth in cloud/AI/engineering programs with utilization discipline.

Quick TA (daily): Uptrend but extended; respect prior highs as resistance; look for consolidation candles / pullback-to-20/50-DMA style entries rather than chasing.

Growth drivers: AI/analytics builds, platform engineering, cloud modernization; strong execution + client mining.

How to use: SIP on dips or buy in thirds around supports; keep risk budget tight given premium valuation.

Tech stocks often get judged harshly on margin moves — but Persistent handled Q2 with maturity. Cloud, digital consulting and data-engineering demand remained steady, helping the company maintain business momentum.

What stood out

Management commentary remained confident, deal momentum supported visibility, and operational discipline helped protect margins. Not flashy numbers — but dependable ones.

Valuation tone

Yes, it trades at a higher multiple than many IT peers — but the premium comes from its positioning in modern digital tech and balanced execution.

Investor takeaway

More of a quality compounder in the IT basket. Market rewards consistency here.

3) Latent View Analytics

What Q2 says: Management commentary around GenAI/agentic work; EBITDA margin guide nudged to 22–23% while investing in Databricks/AI CoE and hiring. Multiple broker notes stayed constructive.

Shareholding (Sep ’25): Promoter ~65.2% (stable).

Fundamentals snapshot: Debt-free; ROE modest (low-teens); reinvesting for growth; no regular dividend.

CMP context: ~₹448 at Oct-31 close.

Valuation read: Re-rates happen when pipeline converts and margins hold despite hiring. Watch order wins outside Tech vertical to diversify.

Quick TA (daily): Momentum reclaimed after Q2; prior supply around recent swing highs—expect back-and-fill. Use defined stops; avoid illiquid intraday trades.

Growth drivers: Data & analytics + AI spending across BFSI/CPG; GenAI proof-of-concepts moving to production.

How to use: Position-sizing matters—mid-cap + earnings sensitivity. Prefer partial entries; review post-results.

Latent View remains a pure-play data analytics and consulting name — a space that grows as digital transformation accelerates across industries.

Q2 highlight

Revenue growth was healthy and the firm continued to build capabilities in AI-led analytics. Client funnel expansion stood out, particularly in BFSI and retail analytics.

Valuation angle

The market still treats it as a long-term growth bet — lower dividends, higher reinvestment. This stock is for patient investors who believe in India’s analytics & AI export story.

Investor takeaway

High growth potential but expect volatility — small cap + niche industry means swings will happen.

4) Chennai Petroleum (CPCL)

What Q2 says: Big turnaround: PAT ₹732 cr vs loss last year; GRM around $9/bbl; crude throughput higher—classic refining swing back.

CMP context: ~₹980 around Oct-31 session.

Balance sheet & ratios: Debt/Equity ~0.38 (Mar-2025); ROE track strong in 3-yr view; dividend payout reasonable for a refiner.

Valuation read: Cyclical—earnings tied to GRMs, crude diffs, inventory gains/losses. Money control comp table shows single-digit/teens PE for refiners (cycle-dependent).

Quick TA: High-beta; respect levels. After sharp moves, expect volatility around results/oil headlines.

Growth drivers: Throughput ramp, potential complex spreads, IOC group benefits; risks from crude spikes, marketing margins, regulatory actions.

How to use: Trade the cycle; don’t extrapolate one quarter. Keep position smaller vs structural compounders.

Among all names here, CPCL offers the contrast — a refining and oil company in a very different sector cycle.

Q2 pulse

Strong refining margins supported results and operational metrics improved. The business has been benefitting from a favourable pricing cycle.

Valuation tone

Much lower PE compared with tech and defence names. Market sees it as value + cyclical play rather than structural growth.

Investor takeaway

Suitable for investors who understand commodity cycles — not a buy-and-forget name. Momentum usually follows crude price trends.

5) Sai Silks (Kalamandir) – Retail / ethnic wear

What Q2 says: Reports indicate PAT up ~69% YoY; management raised FY26 growth outlook (~20% revenue growth with improving margins).

Share price context: ~₹182 at Oct-31 close.

Fundamentals snapshot: Debt reduced; ROE has cooled to single digits in FY25; working-capital days elevated (retail reality).

Valuation read: Retail valuations hinge on like-for-like growth, new store productivity, and gross-margin discipline (assortment + wedding/festive contribution).

Quick TA: Sideways-to-weak after listing rally; watch if 200-DMA base holds and whether festive prints lift sentiment.

Growth drivers: Regional brand strength in sarees/ethnic; store expansion into Tier-2/3; private-label mix. Risks: seasonality, fashion inventory, discretionary slowdown.

How to use: Treat as a smaller-cap retail bet; stagger exposure and track quarterly store metrics.

A retail and ethnic apparel brand that is gradually expanding footprint. The quarter saw stable demand and improving store performance in key markets.

Q2 takeaway

Sales traction remained decent — festive quarters typically favour textile and traditional apparel names. While not a mass headline stock, delivery on expansion strategy is visible.

Valuation & holding note

Institutional ownership remains moderate; promoter holding is solid. This remains an emerging category retail play — steady but not yet in the fast-momentum club.

Promoter / FII / DII one-glance (Sep ’25)

- BEL: Promoter ~51.14%; FIIs ~18% (indicative).

- Persistent: Promoter ~30.56%; Public/Institutions ~69% overall; FIIs ~21–24% band.

- Latent View: Promoter ~65.2%.

- CCPL: Promoter ~67.29%.

- Sai Silks (Kala mandir) Ltd: Promoter ~60.97%.

🧭 Overall Market Context

These five names are not one-type stocks — they represent:

- Defence manufacturing

- Digital & IT

- Analytics & AI

- Oil/refining

- Retail/ethnic apparel

Why it matters?

A diversified economy creates diversified winners. These Q2 performers reflect India’s multi-engine growth setup — technology, defence, consumption and energy all pushing forward.

💡 Investor-Safe View (not advice)

Use these insights as homework starters — not tips.

Smart investors:

✔ Focus on business first

✔ Track results trend, not a single quarter

✔ Avoid chasing rallies blindly

✔ Buy quality on dips, not hype peaks

SEBI-style disclaimer

This article is for education and information only—not investment advice or a solicitation to buy/sell any security, derivative or commodity. Markets involve risk; past performance is not indicative of future results. Please do your own research or consult a SEBI-registered investment advisor.

Further reading 👇

Stock Market 101: Learn Stocks from Zero

Thank you for reaching out. At this time, we’re not interested in any external promotion or email marketing partnerships for kartalks.com.

Please remove this email from your marketing list.