Stock Market 101 – Lesson 15

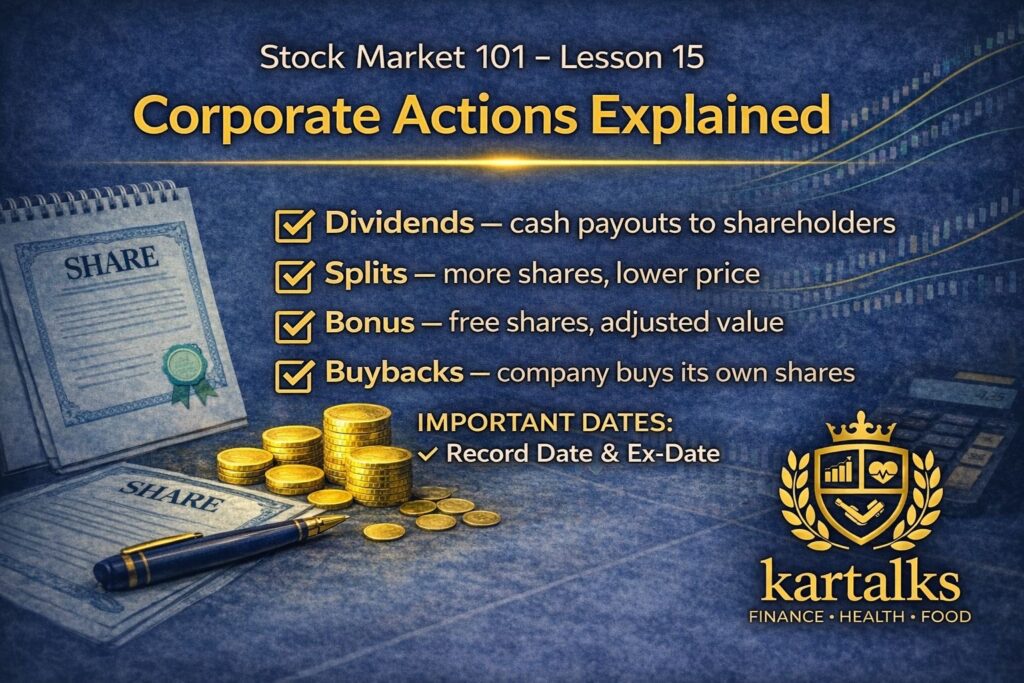

Corporate Actions Made Simple: Dividends, Splits, Bonuses & Buybacks (Beginner Guide)

Hook: The day your share “falls” and you panic 😅

Stock Market 101 Lesson 15 Corporate Actions for beginners: You open your portfolio in the morning and suddenly your stock is down 3–5%. No bad news. No market crash. But your heart still says, “What happened?!”

Many times, this happens because of corporate actions.

Corporate actions are like the company doing “accounting + reward” activities that change the share price, share count, or your cash flow—without changing the real value (most of the time).

In this lesson, you’ll learn the only things beginners actually need:

What dividends, splits, bonuses, and buybacks really mean

The important dates (record date, ex-date)

Simple split math (before/after)

Common traps people fall into

A practical tracker format you can use every month

What are corporate actions (in one line)?

A corporate action is an official decision by a company that impacts shareholders—either by giving cash, issuing extra shares, changing the share count/price, or buying shares back.

Think of it like this:

Dividend → company gives you cash

Bonus → company gives you extra shares

Split → company breaks one share into more shares (price adjusts)

Buyback → company buys its own shares back (reduces share count)

SEBI – Investor Education 👉sebi

1) Dividends: “Cash reward”, but not free money

A dividend is a cash payout from the company to shareholders.

The beginner misunderstanding

Many people think:

“Dividend means extra profit. I’m earning twice!”

Reality:

On the ex-dividend date, the stock price usually adjusts downward roughly by the dividend amount (because the company is paying cash out).

So dividend is not magic. It’s a cash transfer from company → shareholders.

Key dividend terms you must know

Dividend per share (DPS): cash paid per share

Dividend yield: DPS ÷ current price (annualized)

Payout ratio: how much profit is paid out as dividend

Interim vs Final dividend: paid during the year vs end of year

Dividend example (simple)

You own 100 shares

Dividend announced: ₹5 per share

You receive: ₹500 (before taxes/charges as applicable)

But remember: price often adjusts around the ex-date. So don’t buy a stock only for “one-day dividend profit”.

Dividend Explained 👉Investopedia

Record Date vs Ex-Date (super important)

These two dates confuse almost everyone in the beginning. Let’s make it clean.

✅ Record Date

The company checks its shareholder list on this date.

If your name is in the list, you get the benefit.

✅ Ex-Date

This is the most important date for you as an investor.

If you buy on or after the ex-date, you usually won’t get that dividend/bonus/split benefit.

Easy way to remember:

Ex-date = “without benefit” date.

So for dividend/bonus/split, your real checklist is:

“What is the ex-date?”

“Do I hold the stock before ex-date (as per settlement rules)?”

Dividend reinvest: the quiet wealth builder

If you’re investing long-term, dividends are powerful when you reinvest them.

Instead of spending the dividend, you use it to buy more units/shares. That’s how compounding becomes visible.

Practical tip

If you are an index-fund investor: choose the growth option if you want auto-reinvestment style compounding (conceptually).

If you want cash flow: dividend option is more like “payout mode”.

2) Stock Split: same pizza, more slices 🍕

A stock split means:

Your number of shares increases

The price per share decreases

Total value stays (roughly) the same

Split Math (before/after)

Let’s say you hold:

10 shares at ₹1,000 each

Total value = ₹10,000

Company announces a 1:2 split (1 share becomes 2 shares)

After split:

Shares = 20

Price becomes approx ₹500

Total value = still around ₹10,000

Why companies do a split?

Make share price “look affordable”

Improve liquidity (more buyers can participate)

Better trading convenience

Important: Split does not make the company richer. It mainly changes the share structure.

3) Bonus Issue: “free shares”, but value adjusts

A bonus issue means the company gives additional shares to existing shareholders.

Example: 1:1 bonus

If you own 10 shares, you receive 10 more

Total shares become 20

But price adjusts roughly proportionally.

Bonus math (simple)

Before bonus:

10 shares × ₹1,000 = ₹10,000

After 1:1 bonus:

20 shares × approx ₹500 = ₹10,000

Why companies give bonus shares?

Confidence signal (sometimes)

Reward long-term shareholders

Improve liquidity

Use reserves to issue shares (depending on rules)

Beginner warning:

Bonus looks exciting, but it’s not “free profit”. It’s mostly a reshuffling of value into more shares.

4) Buybacks: company buys its own shares

A buyback means the company offers to buy shares back from investors.

Why this matters:

Share count reduces

Earnings per share (EPS) can improve

It may support price sentiment

It signals the company believes shares are undervalued (not always, but often)

Two common buyback methods (conceptually)

Tender offer: company buys at a fixed price from shareholders (limited quantity)

Open market: company buys from the market over time

Beginner truth

Buyback is not automatically “good”. You still need to ask:

Is the company financially healthy?

Are they buying back instead of investing in growth?

Is the buyback price attractive?

The “Corporate Action Reality Check” (don’t fall for hype)

When corporate action news comes, you’ll see headlines like:

“Bonus announced!”

“Stock split declared!”

“Big dividend incoming!”

Before reacting, ask these 4 questions:

✅ 1) Is the business strong or only the headline strong?

Corporate actions don’t fix weak businesses.

✅ 2) What is the ex-date and record date?

If you miss the timing, you miss the benefit.

✅ 3) What happens to price after ex-date?

Price often adjusts. Don’t assume instant profit.

✅ 4) Does it match my goal?

Income goal → dividends matter more

Growth goal → fundamentals matter more

Trading goal → dates + liquidity matter more

Quick visual-style examples you can add in your blog (easy)

Example A: Split (2-for-1)

Before: 50 shares @ ₹800 = ₹40,000

After: 100 shares @ ₹400 = ₹40,000

Example B: Bonus (1:2)

(Meaning: 1 bonus share for every 2 shares held)

Before: 20 shares

Bonus received: 10 shares

Total shares: 30 shares

Price adjusts roughly to reflect increased shares

Example C: Dividend

Holding: 200 shares

Dividend: ₹3 per share

Payout: ₹600 (subject to applicable taxes/charges)

CTA: Corporate Action Tracker Template (simple & practical)

If you track corporate actions once a month, you’ll never be confused again.

Create a Google Sheet/Excel with these columns:

Company

Corporate Action Type (Dividend / Bonus / Split / Buyback)

Announcement Date

Ex-Date

Record Date

Ratio / Amount (₹ or 1:1 etc.)

My Holding Qty

Expected Benefit (cash or extra shares)

Notes (Price adjusted? Any special condition?)

Link (official exchange/company update)

Bonus tip: Add a “Status” column:

Watching / Eligible / Action Taken / Completed

Final takeaway (keep this line in your head)

Corporate actions change the “shape” of your investment, not the “quality” of the company.

Quality comes from business fundamentals. Corporate actions are just events you should understand—not chase blindly.

Further reading

Stock Market 101–Lesson 14 IPOs for Beginners: Process & Allotment Basics

Stock Market 101 – Lesson 13 ETFs & Index Funds: Fees, Tracking, and How to Choose

Stock Market 101 – Lesson 12 Building a Starter Portfolio: 3 Simple Recipes for Beginners

Stock Market 101 – Lesson 11 MA, RSI & MACD

Stock Market 101 – Chart Patterns Explained

India Pre-Budget Forecast 2026 (Part – 2): The Fine Print Investors Should Track

Pre-Budget Market Outlook (Union Budget 2026-27) — What the Market Is Pricing In

How Much Should You Invest Every Month? A Simple Guide for Salaried People

Disclaimer:

This article is for educational purposes only and does not constitute financial advice or a buy/sell recommendation. Please do your own research or consult a licensed financial advisor before investing.

Learning made so easy. Useful and easy to remember. Thanks,

Thank you so much, Shaikh 🙏

Glad you found it useful and easy to understand. 😊

Very Useful Information. Thank You

Thank you

Informative.

Thanks for reading.