Understanding Financial Statements (For Absolute Beginners)

Hook – Read This Before You Buy Any Stock

Hook – Read This Before You Buy Any Stock

Understanding financial statements : Most beginners jump into the stock market by checking share price, news, and maybe a few YouTube videos.

Very few actually look at the numbers behind the company.

But the truth is simple:

If you can read basic financial statements, you’ll immediately be ahead of most retail investors.

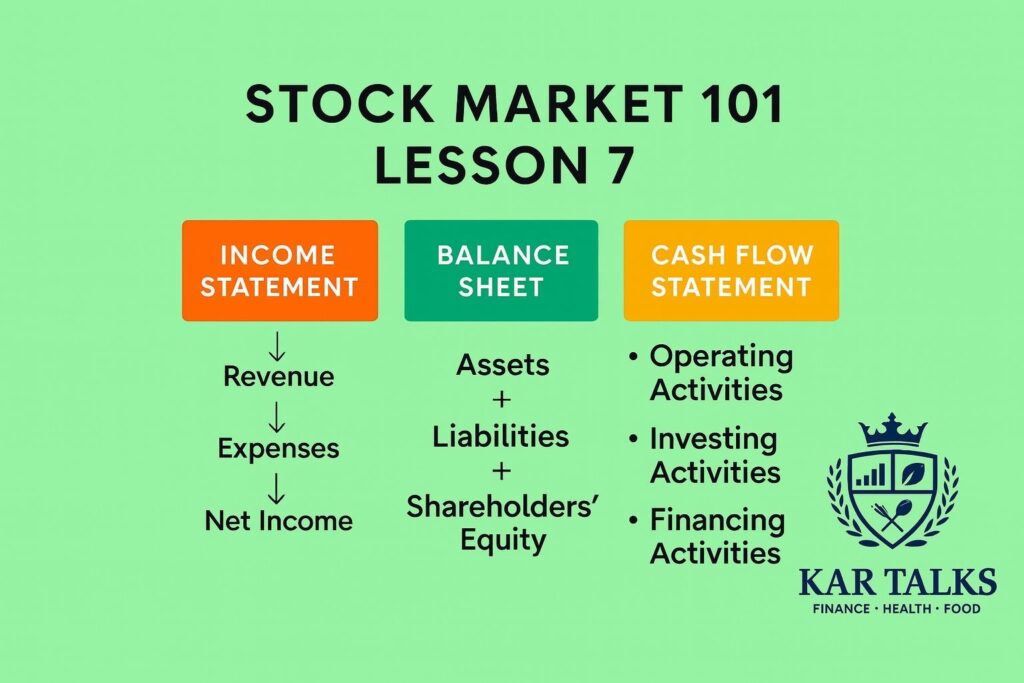

In this Stock Market 101 – Lesson 7, we’ll slowly and clearly walk through Income Statement Basics, Balance Sheet Explained, and the Cash Flow Statement in a way any beginner can understand. No heavy accounting. No formulas. Just simple, practical explanations.

This lesson is part of our Financial Statements for Beginners series and is designed to build your confidence step by step.

Understanding Financial Statements – What You’ll Learn in Lesson 7

Understanding Financial Statements – What You’ll Learn in Lesson 7

By the end of this lesson, you’ll be able to:

- Understand Income Statement Basics – revenue, expenses, and profit

- See the Balance Sheet Explained in a simple way – assets, liabilities, equity

- Read a Cash Flow Statement and know why cash is different from profit

- Connect all three to understand company fundamentals

- Use this knowledge as a strong base for investing for beginners

- Take one more step forward in your journey to learn stock market concepts properly

Why Financial Statements Matter for Beginners

Why Financial Statements Matter for Beginners

When you buy a stock, you’re not just buying a ticker symbol.

You’re buying a business.

To judge a business, you need more than price charts. You need to know:

- Is the company making real money?

- Is it drowning in debt?

- Is it generating cash, or just showing profits on paper?

That’s where financial statements for beginners come into play. You don’t need to become a CA or CFA. You just need to understand the basics of three documents:

- Income Statement

- Balance Sheet

- Cash Flow Statement

These three together give you a picture of company fundamentals. If you want to learn stock market in a serious, long-term way, these are non-negotiable.

Income Statement Basics – Is the Company Profitable?

Income Statement Basics – Is the Company Profitable?

Let’s start with the Income Statement.

Think of it as a movie of how much the company earned and spent over a specific period (like a quarter or a year).

What the Income Statement Shows

What the Income Statement Shows

In simple terms:

Income Statement = Revenue – Expenses = Profit

Key parts in Income Statement Basics:

- Revenue (Sales):

Total money the company earned by selling its products or services. - Expenses:

Money spent on salaries, rent, electricity, marketing, raw materials, etc. - Operating Profit:

Profit from the core business, before interest and taxes. - Net Profit:

Final profit after interest, taxes, and other income/expenses.

Small Example

Small Example

Imagine a company:

- Revenue = ₹100 crore

- Total Expenses = ₹70 crore

- Net Profit = ₹20 crore

This looks good. Now, check a few years:

- Year 1: Net Profit = ₹10 crore

- Year 2: Net Profit = ₹15 crore

- Year 3: Net Profit = ₹20 crore

Profit is rising → good sign.

But this is only the first layer of company fundamentals.

Balance Sheet Explained – What the Company Owns and Owes

Balance Sheet Explained – What the Company Owns and Owes

Now let’s get the Balance Sheet Explained in simple language.

While the income statement is like a movie, the balance sheet is like a photo.

It shows the company’s financial position on a specific date.

Balance Sheet Formula

Balance Sheet Formula

Assets = Liabilities + Shareholder Equity

Key Components

Key Components

- Assets (What the company owns):

Cash, buildings, machinery, inventory, receivables, investments, etc. - Liabilities (What the company owes):

Loans, interest payable, supplier dues, tax liabilities, etc. - Shareholder Equity (Owners’ share):

What belongs to shareholders after paying all liabilities.

Why This Matters for Investors

Why This Matters for Investors

Even if a company looks profitable in the income statement, the balance sheet might show a different story:

- High debt

- Low cash

- Huge short-term obligations

For investing for beginners, one simple rule:

Avoid companies with very high debt compared to equity, especially if profits are not stable.

This is why the Balance Sheet Explained is crucial in any serious attempt to learn stock market analysis.

Cash Flow Statement – Where Is the Real Cash?

Cash Flow Statement – Where Is the Real Cash?

Here’s the part most beginners completely ignore: the Cash Flow Statement.

A company can show profit but still struggle to pay salaries or suppliers. How? Because profit is an accounting number, but cash flow shows actual movement of money.

Three Sections of the Cash Flow Statement

Three Sections of the Cash Flow Statement

- Operating Cash Flow

Cash generated from the core business (this is the most important). - Investing Cash Flow

Cash spent on or received from buying/selling assets, plants, equipment, or investments. - Financing Cash Flow

Cash from loans, issuing shares, paying dividends, or repaying debt.

Why It’s Critical

Why It’s Critical

For company fundamentals, the Cash Flow Statement tells you:

- Is the business self-sustaining?

- Is the company borrowing just to survive?

- Are profits converting into real cash?

A simple thumb rule for investing for beginners:

Long term, you want companies with positive operating cash flow consistently.

How the Three Statements Work Together

How the Three Statements Work Together

To truly understand financial statements for beginners, you must see how all three are connected.

You can think of it like this:

- Income Statement → Tells you how much profit was made.

- Balance Sheet → Shows where that profit is stored as assets or retained earnings.

- Cash Flow Statement → Shows how much of that profit actually turned into cash.

Example:

- A company shows ₹20 crore net profit (Income Statement).

- Balance Sheet shows increasing assets and maybe some debt reduction.

- Cash Flow Statement shows positive operating cash flow of ₹18 crore.

This is healthy: profit is real, cash is flowing in, debt may be coming down.

That’s strong company fundamentals.

Simple 5-Step Framework for Beginners

Simple 5-Step Framework for Beginners

Here’s a simple reading framework you can use every time:

Step 1: Check Revenue Trend (Income Statement Basics)

Step 1: Check Revenue Trend (Income Statement Basics)

Is revenue growing steadily over multiple years?

Step 2: Check Net Profit

Step 2: Check Net Profit

Is net profit rising? Are profit margins stable or improving?

Step 3: Look at Debt (Balance Sheet Explained)

Step 3: Look at Debt (Balance Sheet Explained)

Is debt manageable? Is debt-to-equity at a reasonable level for that industry?

Step 4: Check Operating Cash Flow (Cash Flow Statement)

Step 4: Check Operating Cash Flow (Cash Flow Statement)

Is the company generating positive cash from operations regularly?

Step 5: Compare Profit vs Cash

Step 5: Compare Profit vs Cash

Are profits backed by cash flows?

If profit is rising but cash flow is falling, be careful.

This 5-step method is very useful for investing for beginners who want a structured way to review companies.

Common Mistakes Beginners Make

Common Mistakes Beginners Make

When people learn stock market concepts only through price charts or tips, they often:

- Look only at revenue, ignore debt

- Get impressed by “big assets” but miss high liabilities

- Focus only on net profit, not on cash flow

- Ignore the Cash Flow Statement completely

- Don’t check if the company is borrowing just to survive

By understanding Income Statement Basics, having the Balance Sheet Explained clearly, and learning how to read a Cash Flow Statement, you avoid these traps.

Key Takeaways from Lesson 7

Key Takeaways from Lesson 7

Let’s quickly recap:

- Income Statement Basics tell you if the company is profitable.

- With the Balance Sheet Explained, you can see assets, liabilities, and true financial strength.

- The Cash Flow Statement reveals if profits are backed by real cash.

- Together, these three form the core of company fundamentals.

- This lesson is part of Financial Statements for Beginners, built specially for investing for beginners.

- If you truly want to learn stock market in a serious way, financial statements are your best friends.

Final CTA – Your Next Step

Final CTA – Your Next Step

You don’t need to become an expert overnight.

Start small:

- Pick one company you know

- Download its annual report

- Try applying the 5-step framework from this lesson

Save this lesson, come back to it whenever you analyze a company, and slowly your confidence will grow.

Further reading for Previously published lessons.

Stock Market 101: Learn Stocks from Zero

Stock Market 101 — Beginner’s Course by kartalks. Lesson 4.

financialstatement

Hook – Read This Before You Buy Any Stock

Hook – Read This Before You Buy Any Stock Understanding Financial Statements – What You’ll Learn in Lesson 7

Understanding Financial Statements – What You’ll Learn in Lesson 7 Why Financial Statements Matter for Beginners

Why Financial Statements Matter for Beginners Income Statement Basics – Is the Company Profitable?

Income Statement Basics – Is the Company Profitable? What the Income Statement Shows

What the Income Statement Shows Small Example

Small Example Balance Sheet Explained – What the Company Owns and Owes

Balance Sheet Explained – What the Company Owns and Owes Key Components

Key Components Why This Matters for Investors

Why This Matters for Investors Cash Flow Statement – Where Is the Real Cash?

Cash Flow Statement – Where Is the Real Cash? How the Three Statements Work Together

How the Three Statements Work Together Simple 5-Step Framework for Beginners

Simple 5-Step Framework for Beginners Step 1: Check Revenue Trend (Income Statement Basics)

Step 1: Check Revenue Trend (Income Statement Basics) Common Mistakes Beginners Make

Common Mistakes Beginners Make Key Takeaways from Lesson 7

Key Takeaways from Lesson 7 Final CTA – Your Next Step

Final CTA – Your Next Step