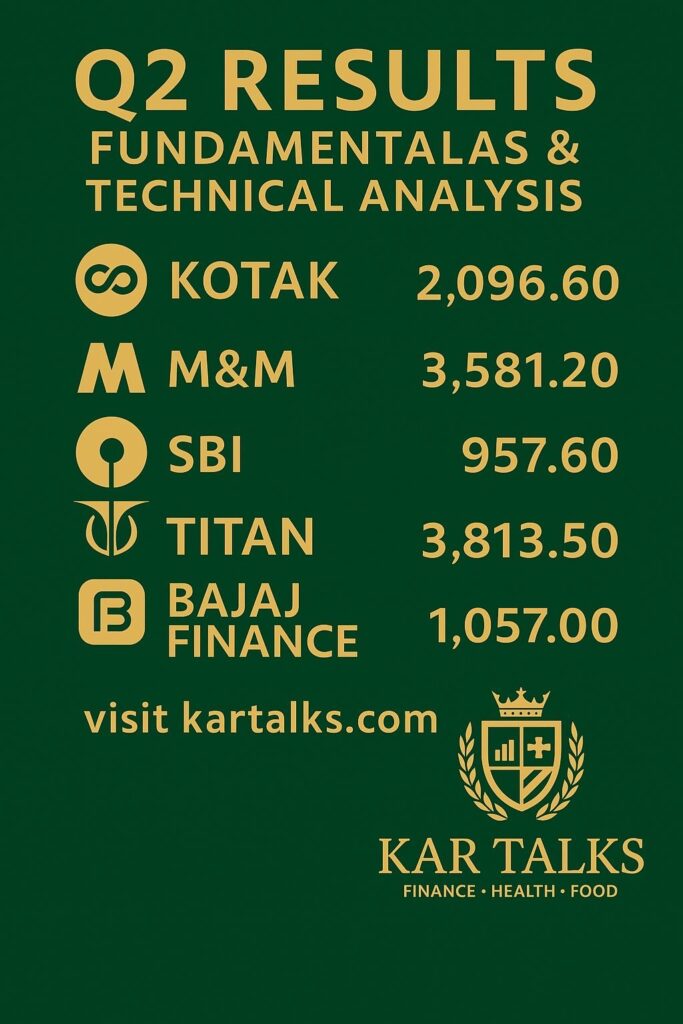

Q2 Results for Kotak, SBI, Titan, M&M, Bajaj Results|kartalks

🏦 Kotak Mahindra Bank – good loan growth, softer profit

On the numbers side, Kotak’s Q2 FY26 was a mix of strength and pressure:

- Standalone net profit dipped about 2.7% YoY to ~₹3,253 crore, mainly because provisions went up.

- Net interest income (NII) grew around 4% YoY to about ₹7,311 crore, which means the core lending engine is still expanding.

- Net interest margin (NIM) is still high at about 4.54%, though slightly lower than last year as cost of funds has risen.

So business growth is healthy on the loan side, but profitability growth is not very exciting in this quarter.

Price & levels (around ₹2,096.60):

- Short-term support zone: roughly ₹2,050–2,070

- Deeper support: near ₹2,000

- Resistance: first band around ₹2,150–2,170, then ₹2,200+

👉 Investor-style idea (not a call):

Kotak is still a quality private bank. Many long-term investors prefer staggered buying closer to ₹2,050–2,000, rather than chasing strength above ₹2,150. For traders, slipping below ₹2,050 is a warning; sustaining above ₹2,170–2,200 improves the momentum picture.

🏛️ SBI – big, cleaner and still growing

Q2 FY26 was strong for State Bank of India:

- Net profit was around ₹20,160 crore, up roughly 10% YoY, helped by gains from the Yes Bank stake sale plus steady loan growth.

- NII grew a little over 3% YoY to about ₹4.30 lakh crore (₹429.8 billion) for the quarter, and margins improved sequentially even though they’re lower than last year.

- Gross NPA ratio eased to around 1.7–1.8%, one of the best phases for SBI’s asset quality.

The message is: big balance sheet, cleaner book, profits still moving up.

Price & levels (around ₹957.60):

- Nearby support: ₹940–945

- Deeper support: ₹900–910

- Upside resistance: first near ₹975–980, then the psychological ₹1,000 zone

👉 Investor-style view:

SBI has moved from “turnaround PSU” to “core portfolio” for many. Accumulation closer to ₹940 or any 5–10% dip from highs is common. Fresh buying right under ₹1,000 generally needs a longer time horizon, because the stock has already had a big run.

💍 Titan – jewellery & premium brand story intact

Titan’s Q2 FY26 numbers again reminded the market why it trades at a premium:

- Consolidated net profit jumped about 59% YoY to ~₹1,120 crore.

- Overall revenue grew roughly 20%+ YoY, with the jewellery business still the main growth engine.

Broker previews had already expected a strong quarter; the actual print basically confirmed that the core jewellery franchise is still compounding well.

Price & levels (around ₹3,813.50):

- First support: near ₹3,720–3,730

- Strong support band: ₹3,600–3,650

- Resistance: around ₹3,880–3,900, then the psychological ₹4,000 mark

👉 Investor-style view:

Titan almost never looks “cheap” on P/E, but it keeps justifying valuations with earnings growth. Many long-term investors like buying dips towards ₹3,600–3,650 instead of entering at all-time highs. Short-term traders usually respect ₹3,600 as the key line; below that, momentum weakens, above ₹3,900–4,000 momentum traders get interested again.

🚙 Mahindra & Mahindra (M&M) – SUVs + farm giving a solid base

M&M’s Q2 FY26 was clearly strong:

- Consolidated PAT came in at around ₹3,673 crore, roughly 16–28% higher YoY depending on the one-off adjustments.

- Revenue jumped about 21–22% YoY to roughly ₹45,000–46,000 crore, driven mainly by SUVs and tractors.

The SUV franchise and the farm-equipment business continue to be the big profit pillars.

Price & levels (around ₹3,581.20):

- Nearby support: ₹3,500–3,520

- Deeper support: around ₹3,400

- Resistance: first near ₹3,650–3,700, then closer to the 52-week high region around ₹3,750–3,800

👉 Investor-style view:

M&M often sits in the “core auto” bucket for investors who want both passenger vehicle + rural exposure in one name. Fresh staggered buying closer to ₹3,400–3,500 is a more comfortable zone than chasing at new highs. For traders, holding above ₹3,500 keeps the trend healthy; losing that level changes the risk–reward.

💳 Bajaj Finance – AUM growth back in high gear

Bajaj Finance didn’t just give a basic result; it gave a strong operating update:

- AUM grew about 24% YoY to nearly ₹4.62 lakh crore as of 30 September 2025.

- New loans booked rose about 26% YoY, and the customer base crossed 110 million, showing the franchise still has deep retail reach.

So growth is clearly back at full speed after the earlier caution around regulatory noise.

Price & levels (around ₹1,057.00):

- First support: roughly ₹1,020–1,030

- Deeper support: ₹980–1,000

- Resistance: near ₹1,080–1,100

👉 Investor-style view:

This is a classic high-growth, high-valuation NBFC. Many investors prefer SIP-style entries rather than big one-shot buying, because corrections can be sharp. Traders usually watch ₹1,020 as a risk marker on the downside and take profits gradually as price approaches ₹1,080–1,100.

Simple combined view & rough entry–exit thinking

If you put all five together:

- Banks & NBFCs: Kotak, SBI, Bajaj Finance

- Auto & rural play: M&M

- Premium consumption: Titan

You basically cover a large part of India’s financial system + consumption + auto/rural story.

Very broadly (not advice):

- Investors usually try to buy near support, not at resistance.

- For long-term portfolios, many people:

- Accumulate SBI, Kotak and Bajaj Finance on dips.

- Add Titan and M&M slowly, especially after corrections or sideways phases.

- Exits are often planned around major resistance zones or when the stock breaks and closes well below key supports for some time.

Because risk appetite, time horizon and capital size are different for everyone, exact entry and exit decisions should be done with a professional.

Further reading 👇

BEL, Persistent, Latent View, Chennai Petroleum, Sai Silks (Kalamandir)

📊 Fundamentals for Growth Stocks

Stock Market 101: Learn Stocks from Zero

Disclaimer:

This content is for educational and informational purposes only. It is not investment advice and is not a recommendation to buy, sell or hold any security or derivative. The author is not a SEBI-registered investment advisor. Company results and levels mentioned are based on publicly available information as of early November 2025 and may change. Please consult a SEBI-registered advisor before making any investment or trading decision. Trading and investing involve risk, including possible loss of capital.